tennessee inheritance tax rate

Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. The top estate tax rate is 16 percent exemption threshold.

Tennessee Health Legal And End Of Life Resources Everplans

Even though this is good news its not really that surprising.

. Tennessee is an inheritance tax-free state. Its paid by the estate and not the heirs although it could reduce the value of their inheritance. There is a 1170 million exemption for the federal estate tax in 2021 going up to 1206 million in 2022.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Tennessee is an inheritance tax and estate tax-free state.

Those who handle your estate following your death though do have some other tax returns to take care of such as. In May 2012 legislation was enacted which will phase out the Tennessee inheritance tax by 2016. IT-17 - Inheritance Tax -.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. No estate tax or inheritance tax. February 26 2021 1036.

2 An estate tax is a tax on the value of the decedents property. Tennessee is among the states that dont impose estate tax and inheritance tax on the residents and their estates. However there are additional tax returns that heirs and survivors must resolve for their deceased family members.

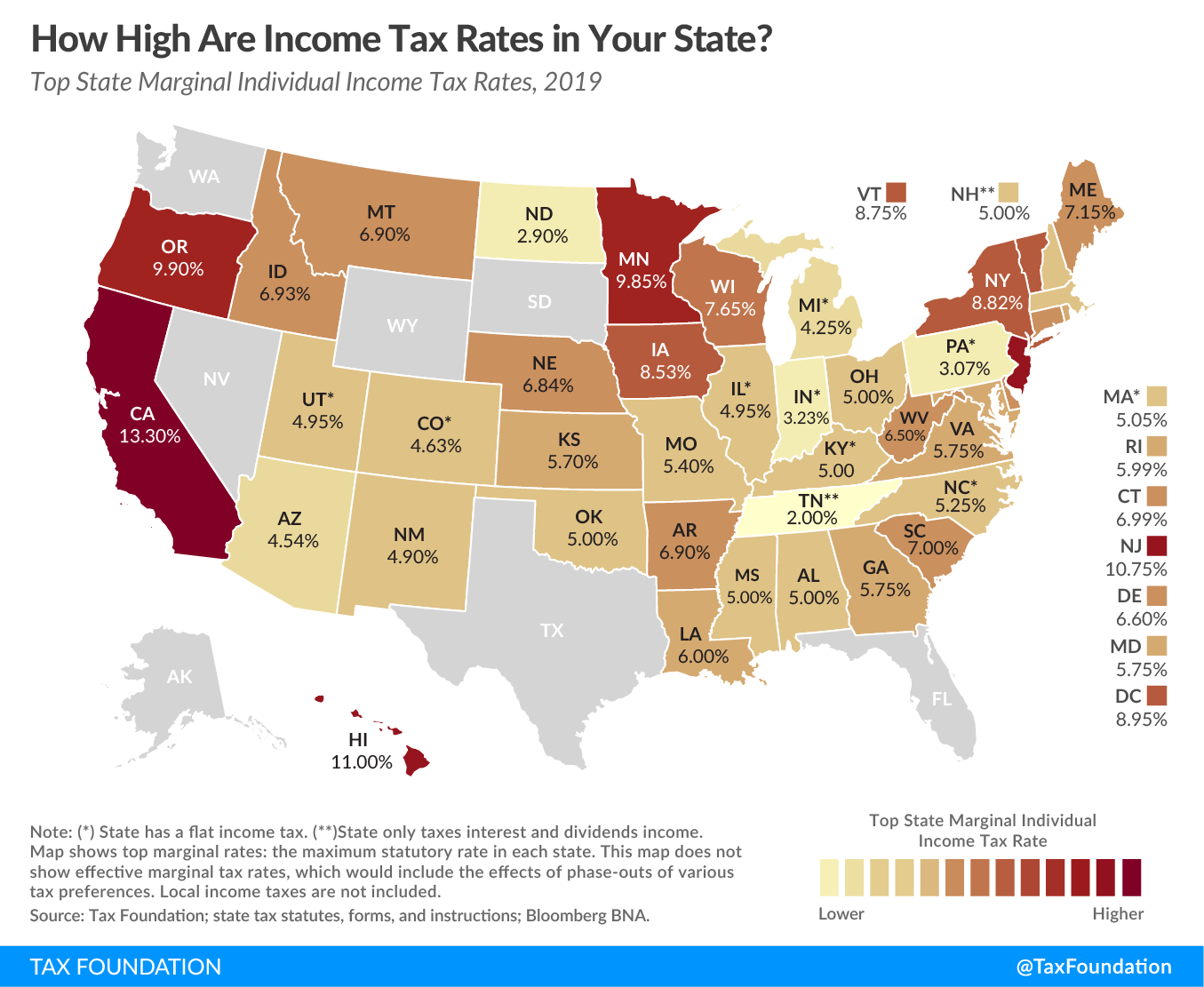

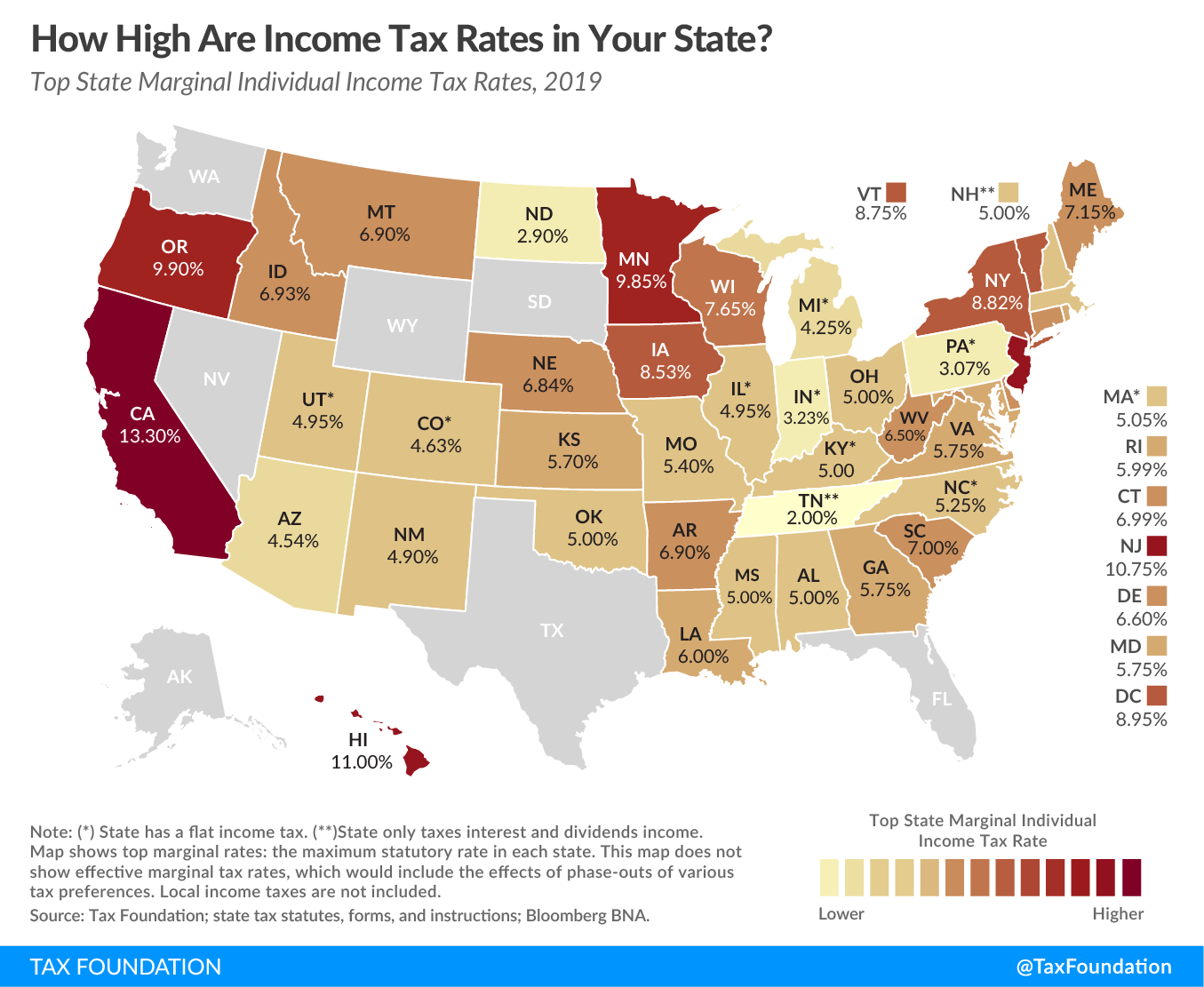

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. The tax rate ranges from 55 at the lower end to upwards of 95 at its highest.

However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. No estate tax or inheritance tax. The taxes that other states call inheritance taxes are not based on the total value of the estate.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident.

Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. Was this article helpful. Next year it will increase to 500000000 and then it will be abolished in 2016.

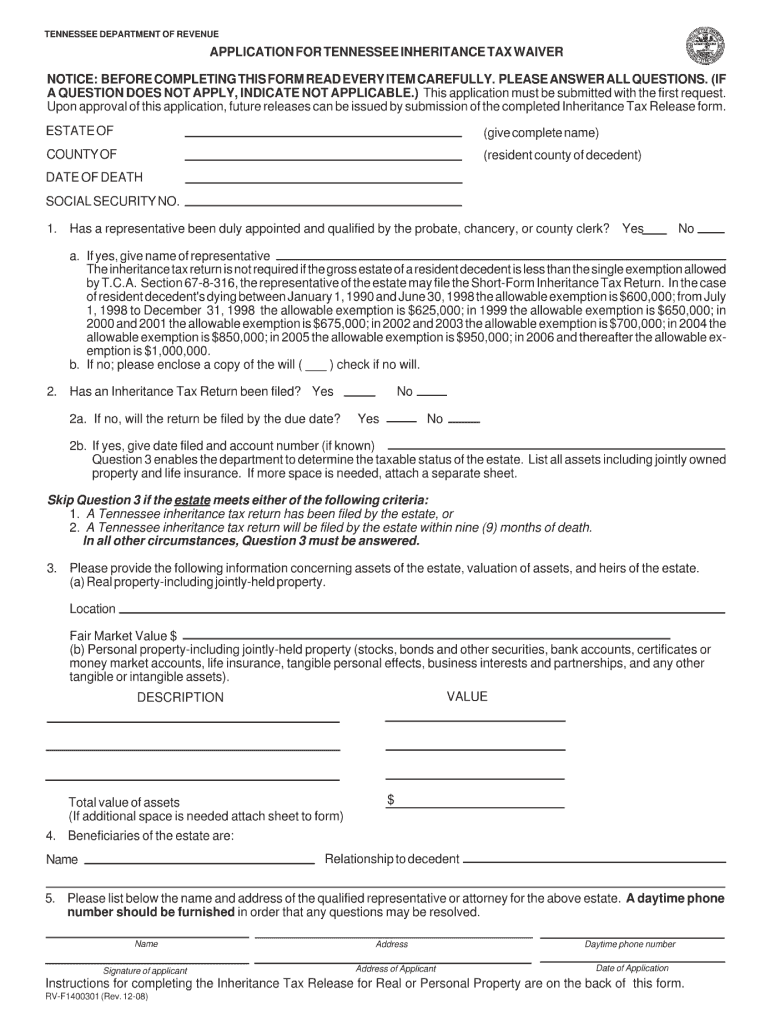

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. They are imposed on the people who inherit from you and the tax rate depends on your family relationship. 0 out of 0 found this helpful.

Te current top gift and estate tax rate in Tennessee is 95 and Tennessee only allows a 13000 exemption per recipient per year as does federal law. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. It is possible though for Tennessee residence to be subject to an inheritance tax in another state.

That exemption amount increases to 5000000 beginning January 1 2015. As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. An inheritance tax is a tax on the property you receive from the decedent.

What is the state of Tennessee inheritance tax rate. State inheritance tax rates range from 1 up to 16. The estate tax in Tennessee was fully repealed in 2016.

The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. The federal exemption is portable for married couples. The Federal inheritance tax exemption for 2014 was raised to 534000000 today.

What is the inheritance tax rate in Tennessee. No estate tax or inheritance tax. Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000.

The inheritance tax is paid. It has no inheritance tax nor does it have a gift tax. For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within the state of Tennessee and the gross estate exceeds 1250000.

No estate tax or inheritance tax. Though Tennessee has no estate tax there is a federal estate tax that may apply to you if your estate is of sufficient value. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end.

The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Each due by tax day of the year following the individuals death. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95.

Tennessees tax exemption schedule is as follows. Federal Estate Tax. IT-16 - No Beneficiary Classes for Inheritance Tax.

The Tennessee inheritance tax exemption allows for any estate valued under the set amount to be exempt from paying the inheritance tax. Year Amount Exempted. Some examples of tax returns involve final individual federal and state income tax returns federal estate income tax returns that are due by April 15 of the year following the persons.

Only seven states impose and inheritance tax. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Anything over these amounts will be taxed at a rate of 40.

Inheritance tax is levied on the estate after the procedure of inheritance which makes heirs responsible for the tax due. For example if a Tennessee resident receives in Heritance from someone who died in Pennsylvania they can. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident.

The inheritance tax is repealed for dates of death in 2016 and after. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. The inheritance tax is levied on an estate when a person passes away.

Final individual federal and state income tax returns. IT-1 - Inheritance Tax Repealed. There is no federal inheritance tax but there is a federal estate tax.

However there are several cases when the Tennessee residents may become responsible for paying certain taxes inheriting an estate. Surviving spouses are always exempt. The exemption amount for a decedents estate is currently 2000000 for any decedents death occurring in 2014.

Married couples can shield up to 2412 million together tax-free.

Chambliss 2014 Estate Planning Seminar Pptx

Us State Tax Planning Gfm Asset Management

Calculating Inheritance Tax Laws Com

Tn Rv F1400301 2008 Fill Out Tax Template Online Us Legal Forms

Retiring In These States Will Cost You More Money Vision Retirement

Historical Tennessee Tax Policy Information Ballotpedia

State Estate And Inheritance Taxes

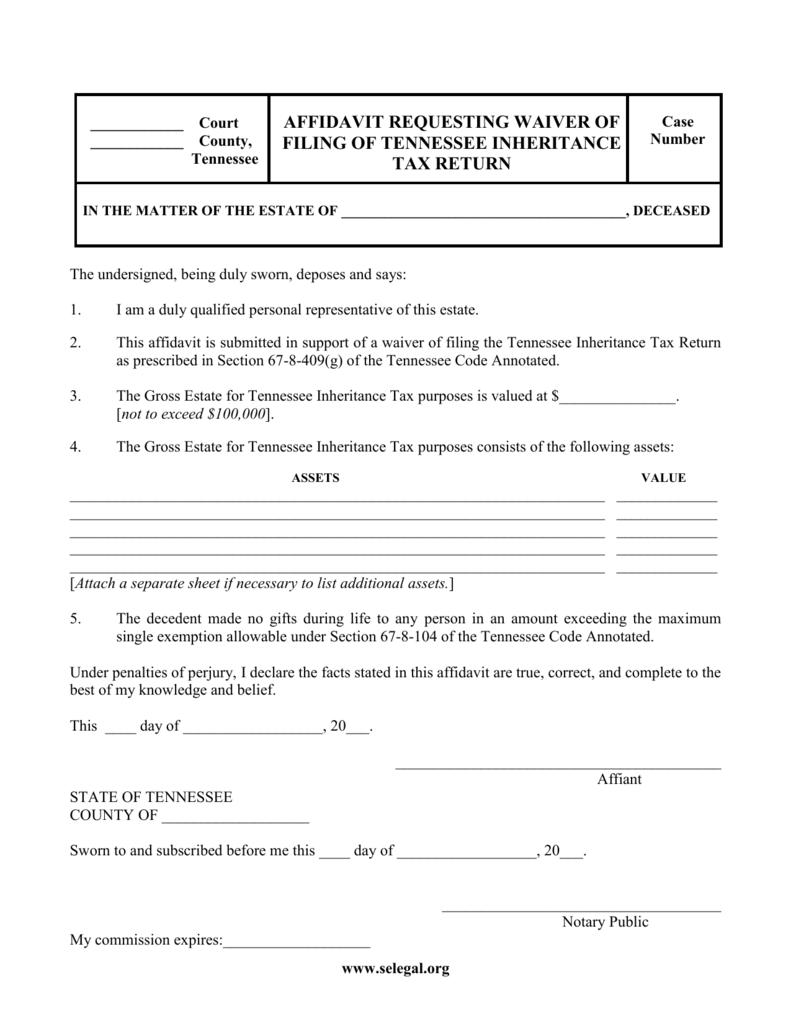

Affidavit Regarding Inheritance Tax Return

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

States You Shouldn T Be Caught Dead In Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form Inh 301 State Inheritance Tax Return Long Form

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die